Fees vs commission transparently outlined

Fee focused and Commission free investing

Aisa International do not charge commission, rebating it all. Our fees are below in Euro:

(for currencies other than Euro please use the current exchange rate as a guideline, although we will provide exact figures at time of agreement)

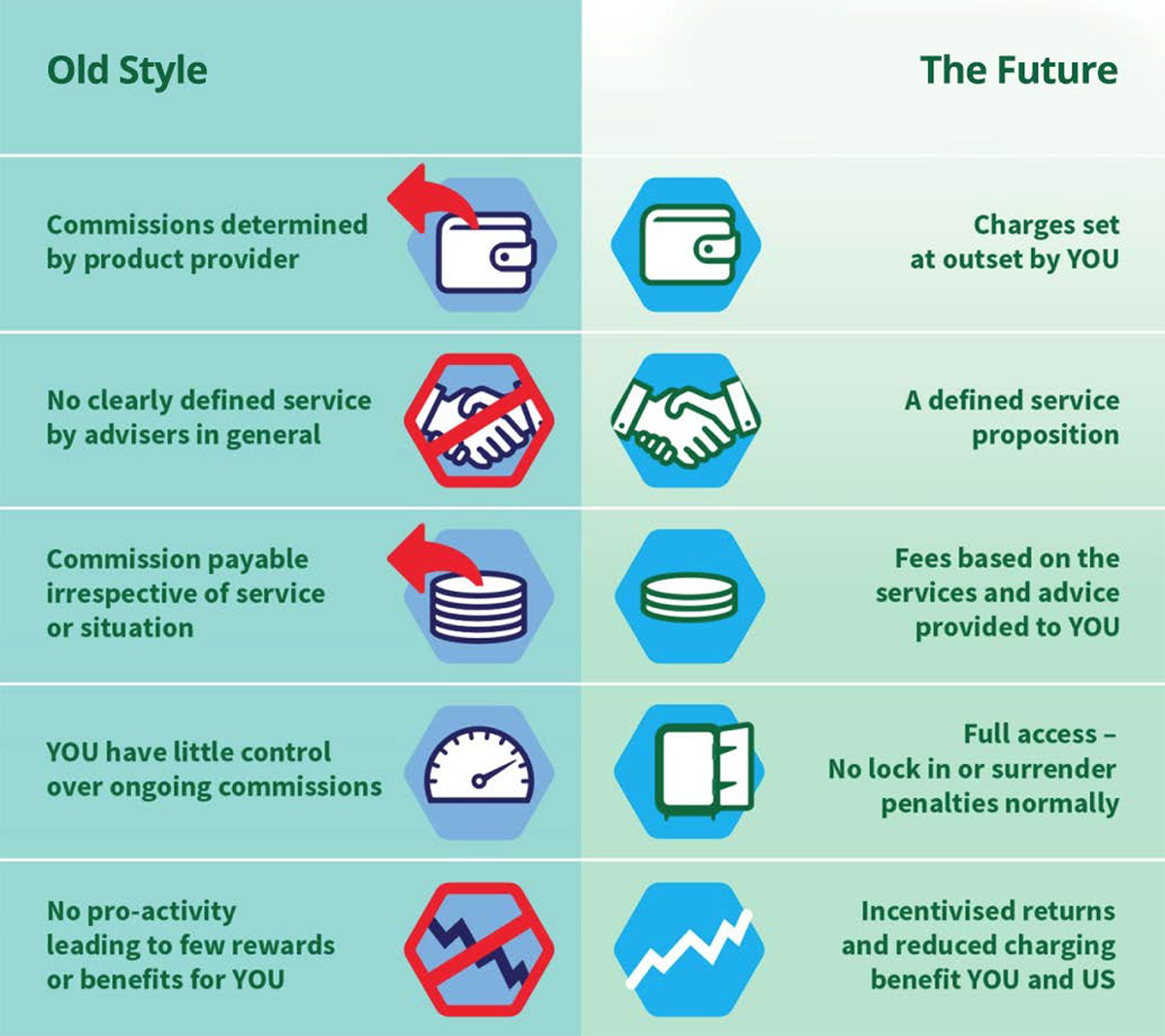

Advantages & Disadvantages: Fees › | Commission ›

Know the FACTS!

1. When you take financial advice, you can pay a separate fee, or elect to have the product pay a commission to your adviser.

2. You are often told that where there is a commission it is FREE advice which is understandably enticing.

3. In comparison, a fee appears a direct cost.

4. It is what you are not told about commission that does the damage. Often the adviser is encouraged to recommend the product with the largest commission rather than what is best for you.

5. The larger the commission the higher the ongoing charges and surrender penalties, and the bigger the impact on your returns and your future.

4 key points that everyone should know about commission:

1. Commission is clawed back through higher charges for many years (Some apply for lifetime).

2. You have an access surrender charge on your fund(s) of up to 10%.

3. The additional higher charges linked to funds reduce your net returns. Often severely.

4. You may have been placed in higher risk investments in an attempt to compensate for charges.

In addition to all these higher charges, we find that in many cases, you will also be put into other commission generating products.

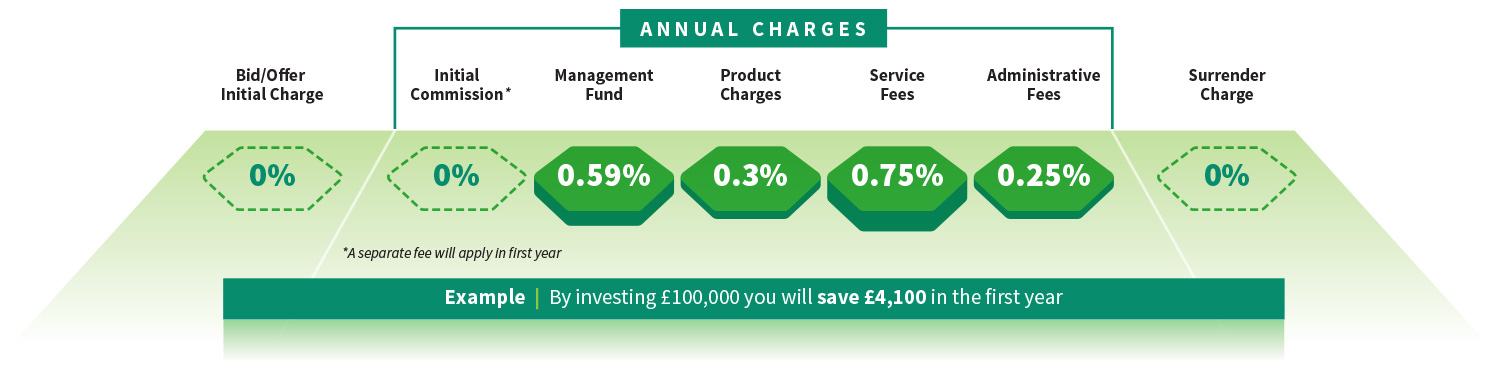

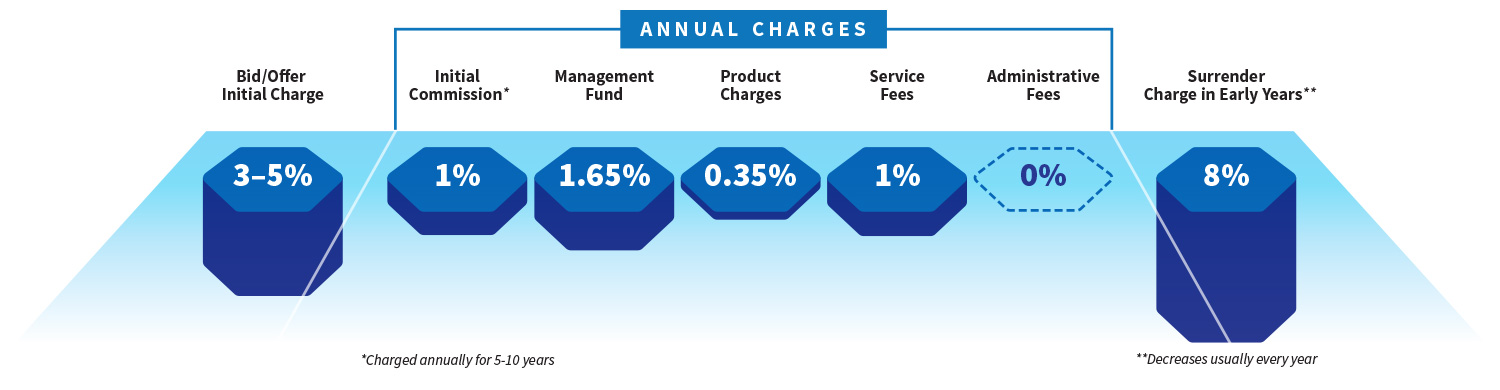

Here are 2 examples illustrating the charges you can expect in the first year of a COMMISSION based product versus FEE based advice. You can see that when you are told you are receiving FREE advice that it is anything but free

Fees

Advantages

- Client retains control of costs

- Removes salesperson commission/product bias

- Transparent – Agreed by clients at outset

- Lock in periods for commission removed

- Adviser truly independent of product company

- No need to sell a product if not needed

- No need to sell a product purely to earn fee

- 5 years charges less than commission charges

- Client chooses adviser now and in future!

- No hidden agenda- all transparent

Disadvantages

- Visible Cost – some clients do not like it

- Good advice is not Free advice

- Reduce initial investment by agreed fee

- May require paying via invoice

Commission

Advantages

- It is sold as “Free” advice

- No need to consider invoices

- Initial investment appears to have no fees deducted (Surrender penalties apply instead)

- Adviser has no requirement to justify fees if not disclosed fully

- May be only way to obtain advice locally

Disadvantages

- Control is taken away from client

- Salesperson has commission/product bias

- Lock in periods to cover commission paid

- Surrender or access penalties apply

- Not Transparent – often hidden from clients

- Salesperson only gets paid if they sell a product (even if not needed)

- Commission can be paid twice- double dipping

- Invariably significantly more expensive

- Does not need to be justified to clients

- Often hidden switching costs for investments

- Hidden fees = Hidden agenda